20 Good Pieces Of Advice For Picking AI Stock Trading Sites

20 Good Pieces Of Advice For Picking AI Stock Trading Sites

Blog Article

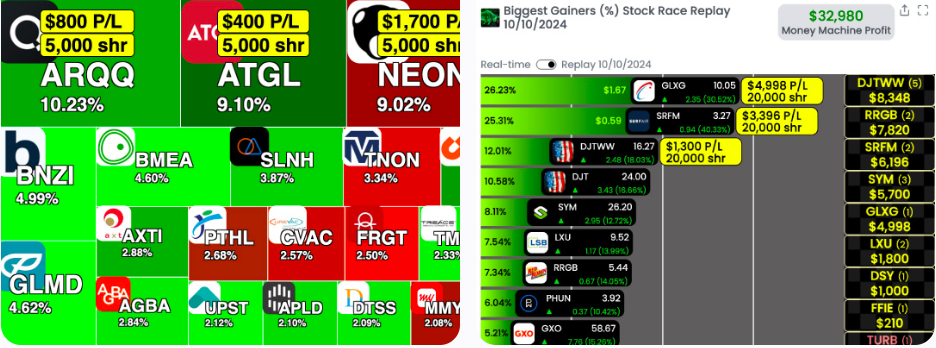

Top 10 Things To Consider When Looking At Ai Trading Platforms Based On Their User Interfaces And Experiences

The User Interface (UI) and User Experience (UX) of AI platforms for predicting and analyzing stocks are essential to making sure that they are efficient, usable as well as overall satisfaction. A poorly-designed interface can inhibit decision-making, even if AI models underlying the interface are robust. Below are the top ten tips for assessing the UI/UX.

1. Assess the ease of use as well as the intuitiveness, simplicity and ease of use.

Navigation: Make it simple to navigate the platform, including menus, workflows and buttons.

Learning curve - Assess how fast a user can grasp the platform and grasp the platform without a lot of training.

Consistency: Look for uniform patterns of design (e.g. buttons or color schemes and so on.) across the whole platform.

2. Check for Customizability

Dashboard customization: Take a look to see if you can customize dashboards so that they show relevant data as well as graphs and metrics.

Layout flexibility - Ensure that the platform allows users change the size or layout of widgets as well as charts.

Preferences and Themes: Determine that the application supports dark or light modes, or any other visual preferences.

3. Visualize data quickly and easily

Chart quality - Ensure the platform includes interactive charts in high resolution (e.g., line charts and candlestick charts) and includes zooming, panning, and other functions.

Visual clarity - Examine to see if data are displayed clearly, using appropriate tools, labels or legends.

Real-time updates: Verify if visualizations are updated in real-time to reflect market fluctuations.

4. Test for Speed and Reactivity

Loading time: Make sure the platform is loaded quickly, even when working with large data sets or complex calculations.

Performance in real-time: Verify that the platform is capable of handling data feeds immediately without any lag or delay.

Cross-device Compatibility: Check if the application works with other gadgets (desktops or mobiles).

5. Examine accessibility

Mobile app: Find out whether there's a fully-featured mobile application that allows trading on the move.

Keyboard shortcuts: Make sure the platform is able to support keyboard shortcuts for advanced users.

Accessibility Features: Check if the platform is compliant with accessibility standards.

6. Use the Examine Search and Filtering Function to examine your information.

Search effectiveness: The platform must enable users to search quickly for indexes, stocks as well as other investments.

Advanced filters: See whether you can narrow your results by using filters (e.g. sector or market capital, performance metrics).

Saved searches. Check the platform's capability to allow users to store frequently used search terms, or filters.

7. Check for Alerts & Notifications

Customizable Alerts: Users may create alerts based on specific conditions, such as price thresholds, spikes in volume, and news happenings.

Notification delivery: Verify if alerts are delivered via multiple channels (e.g. email, SMS, in-app notifications).

Timeliness: Verify that alerts are promptly and precisely sent.

8. Integrate with other tools

Broker integration: Make sure that your platform seamlessly integrates with your brokerage account to allow easy trading execution.

API access: Determine whether the platform allows API access to advanced users to create custom workflows or tools.

Third-party platforms: Check to determine if your platform is able to be integrated with other programs (such as Excel Google Sheets or trading bots).

9. Assess Help and support Features

Onboarding tutorials - Look to see if there's tutorials and walkthroughs available for those who are brand new.

Help center: Ensure that the platform provides a comprehensive knowledge base or a help center.

Customer support: Find out whether you have a fast customer support (e.g. chat on the internet, email or phone).

10. Test Overall User Satisfaction

User feedback Research and testimonies to determine the satisfaction of customers.

Trial period: Take advantage of the demo or trial version for free to test the platform for yourself and evaluate its functionality.

Examine the error handling of the platform.

Bonus Tips

Aesthetics. While function is a key aspect, a pleasing visual design can enhance overall user experience.

Performance under stress Test your platform's performance in high-volatility markets to ensure it's stable and responsive.

Go to the community or forums to see if there is a user group that allows users to discuss tips and provide feedback.

By following these tips to evaluate the UI/UX of AI trading platforms for stock prediction or analysis and ensure that they are efficient, user-friendly, and compatible with your needs in trading. A well-designed UI/UX will significantly enhance your ability to make well-informed choices and effectively execute trades. Have a look at the recommended look at this for ai investment platform for website info including trading ai, ai trade, ai investing, investing ai, ai trading, AI stock trading app, AI stock trading app, chart ai trading assistant, ai for investment, options ai and more.

Top 10 Tips For Evaluating The Transparency Of Ai-Based Stock Trading Platforms

Transparency is a factor to consider when evaluating AI platforms for prediction and trading in stocks. Transparency helps users be confident in the operation of the platform, comprehend the decisions made, and validate the accuracy of predictions. Here are 10 best tips to assess the transparency of these platforms:

1. AI Models - A Simple Explaination

TIP: Make sure the platform clearly explains AI models and algorithms utilized to predict.

Understanding the technology's foundation lets users evaluate its reliability.

2. Sources of Data Disclosure

TIP: Determine if the platform is transparent about the sources of its data (e.g., historical stock information, news, social media, etc.).

What: By knowing the sources of data You can be sure that the platform is using trustworthy and accurate data sources.

3. Performance Metrics and Backtesting Results

TIP: Always look for transparent reporting on performance metrics such as accuracy rates and ROI, in addition to the results of backtesting.

This will enable users to evaluate the efficacy of the platform and its past performance.

4. Updates and notifications in real-time

Tips. Find out if your platform provides real-time data and alerts regarding trades or modifications to the system, for example trading predictions.

Reason: Real-time transparency keeps users informed about the most critical actions.

5. Limitations: Communication that is open

Tips: Ensure that the platform clearly outlines the dangers and limitations of its trading strategies as well as predictions.

What's the reason? Recognizing the limitations of an item builds trust, which helps users make better informed choices.

6. Data in Raw Data to Users

Tip: Check if users can access the raw data or intermediate results that AI models use.

What's the reason? Users can perform their own analysis and test their theories by accessing raw data.

7. Transparency of Costs and Fees

Check that the platform clearly states all subscription fees and other hidden costs.

Transparent pricing helps build trust and helps avoid surprises.

8. Regular Reporting and Audits

Tips: Make sure the platform provides regular reports or is subject to audits by a third party to validate its operations and performance.

The reason: Independent verification adds credibility, and ensures accountability.

9. The logical explanation of predictions

Tips: Make sure the platform has information on how predictions or recommendations (e.g. importance of feature and decision tree) are created.

Why Explainability allows users to understand AI decisions.

10. Customer Feedback and User Support Channels

Tip: Check whether the platform has open channels to receive feedback from users and offers support. It is also important to determine whether it responds to user complaints in a clear and transparent manner.

Why: Responsive communication demonstrates an interest in transparency and the satisfaction of users.

Bonus Tip - Regulatory Compliance

Make sure the platform is compliant with the relevant financial regulations and discloses the status of its compliance. This provides an extra layer of security.

Make informed choices by taking a look at all these aspects. Have a look at the best can ai predict stock market hints for more examples including AI stock predictions, best ai for stock trading, investing with ai, ai for trading stocks, best ai trading platform, how to use ai for copyright trading, free AI stock picker, stocks ai, stock trading ai, how to use ai for stock trading and more.